Article Updated: January 7, 2023

Insurance Claim Adjuster Secret Tactics

The Problem: Insurance Adjuster’s Low Offer

There is a shortlist of claim adjuster secret tactics that they use to justify a lowball settlement offer. There are very specific ways to beat each of those secret tactics. In this article you will learn:

♦ 6 common insurance claim adjuster tactics for making lowball insurance settlement offers

♦ Why some of those tactics are actually secret weapons you can reverse to increase your settlement

♦ How to respond to a low settlement offer for those 6 common scenarios

♦ See a sample response to a low settlement offer based on each of those 6 tactics

Who are we and how do we know these inside tricks?

The Solution: IAG Fights Back

We are the Injury Advocates Group, a boutique personal injury law office that consults personal injury victims. Fighting car insurance companies, and insurance adjuster low ball offers, is what we do. In fact, it is literally the only thing we do.

You can see a small sample of our lawyers’ results and judge for yourself how good you think we are. We have recovered well over $10,000,000 for people fighting car insurance companies. By reading this article, you will appreciate that we know the insurance company’s playbook, and know how to use it against them.

Using this Playbook

This article is divided into 6 chapters. Each chapter covers one insurance adjuster tactic and the secrets to defeating that tactic with a powerful, truthful, response. Use the hyperlinked table of contents below to jump to the chapter that covers your issue and beat the insurance company at their own game.

If you received an insurance adjuster’s low ball offer for a reason not covered in this article, reach out and speak with us. We offer a 30 minute, no obligation, free consultation for all first-time callers.

Table of Contents

Insurance Low Balling Me Because: They’re Blaming My Past

Chapter 1: I Was in Prior Car Accidents

Chapter 2: I Have Pre-Existing Health Problems

Insurance Low Balling Me Because: They’re Twisting The Accident Scene

Chapter 3: My Car Does Not Look That Bad

Chapter 4: I Did Not Leave the Scene in An Ambulance

Insurance Low Balling Me Because: They’re Attacking the Timing of My Treatment

Chapter 5: I Did Not Immediately See a Doctor a/k/a “Delayed Treatment”

Chapter 6: I Had “Gaps” in My Medical Treatment a/k/a “Inconsistent Treatment”

Chapter 1:

I Was in Prior Car Accidents

They’re Blaming Your Past

Can Prior Car Accidents Jeopardize Your Settlement?

If you receive an insurance adjuster’s low offer because you were in a prior car accident, you may have a problem. Most of the time, this is a lazy and bogus excuse for lowballing you. Some of the time, the adjuster’s position has merit.

The secret to defeating this insurance adjuster tactic is digging into the facts. You have to compare and contrast your medical issues from the prior accident to the medical issues for the current accident. If they overlap, you have a problem. If they do not, you can call the insurance adjuster out for this tactic and ask them to re-evaluate the case.

A few examples help illustrate this point.

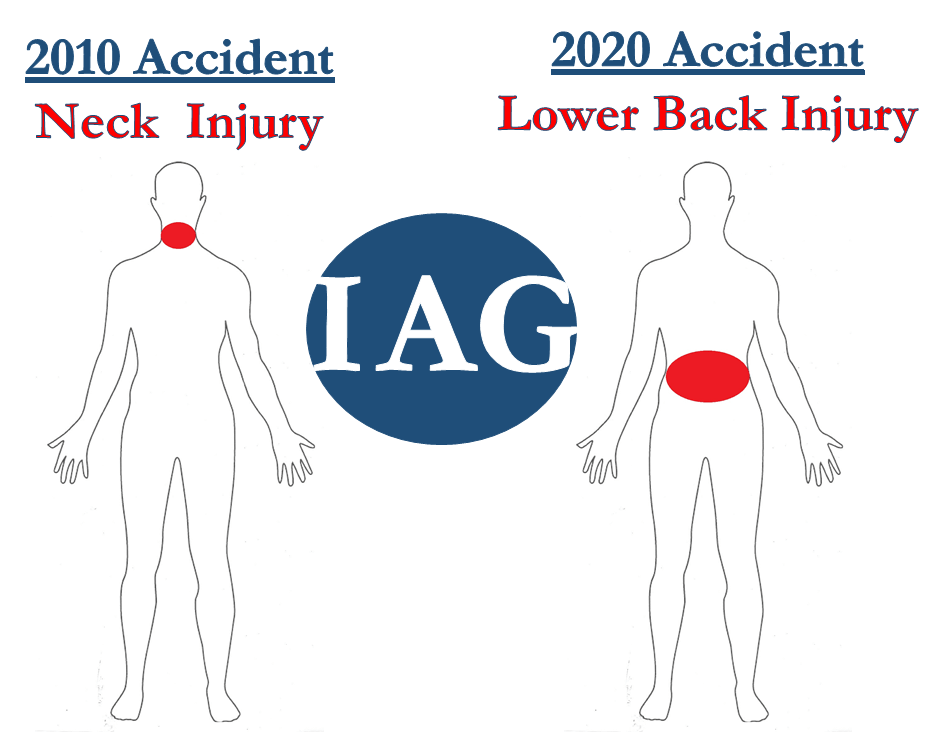

Hypothetical: Neck + Back Injuries

Consider a hypothetical where you were in a car accident in 2010. In that car accident, you injured your neck. Specifically, you injured the soft tissues in your neck. In 2020, you were involved in a second car accident. In that accident, you injured your lower back.

In trying to settle your 2020 car accident, you receive a low ball offer from the insurance company. The adjuster tells you it is because you have a history of prior car accidents, and she considered that in valuing your case and deciding on the settlement offer.

You call my office and ask, “my insurance company is low balling me, right?”

The answer is yes. A response to a low settlement offer in this situation might include a visual, like this:

That is an easy situation. Let’s try something more difficult.

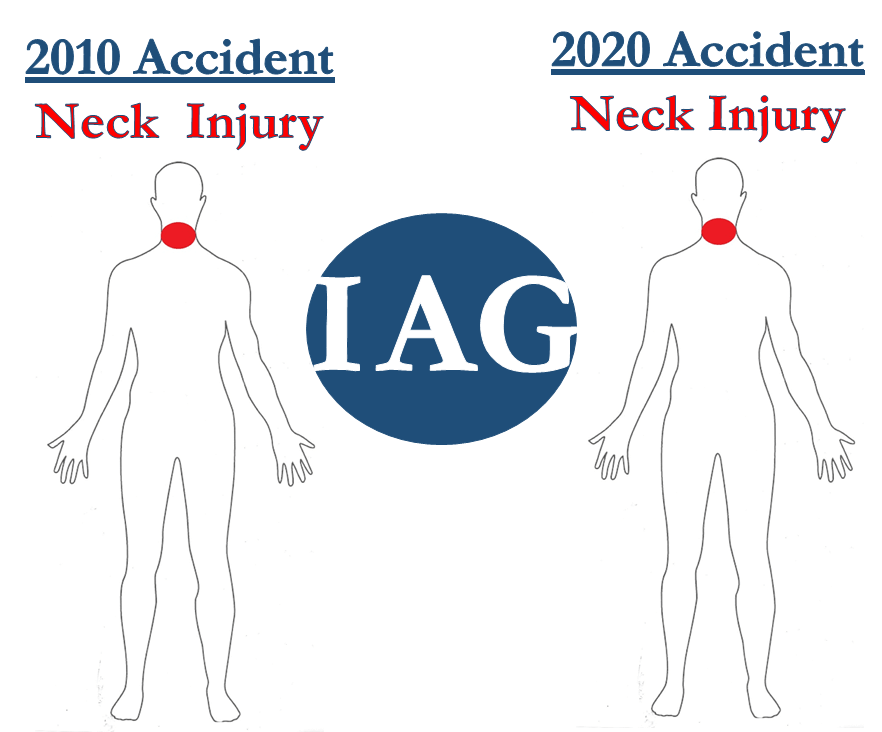

Hypothetical: Neck + Neck Injuries

Consider a hypothetical where you were in a car accident in 2010. In that car accident, you injured you neck. Specifically, you injured a spinal disc in your neck, and had a neck fusion surgery. In 2020, you were involved in a second car accident. In that accident, you injured the soft tissues in your neck with a whiplash injury.

In trying to settle your 2020 car accident, you receive a low ball offer from the insurance company. The adjuster tells you it is because you have a history of prior car accidents, and she considered that in valuing your case and deciding on the settlement offer.

Again, you call my office and ask, “my insurance company is low balling me, right?”

The answer is maybe. An illustrative response to that lowball offer would not be helpful, because it would look like this:

A more detailed anatomical response could help. You can explain to the adjuster that the 2010 car accident was a spinal disc injury and the 2020 car accident was a soft tissue injury. Two different injuries, so no relationship, and your offer should not be discounted.

Sounds easy, right? Not really. Keep reading to find out why.

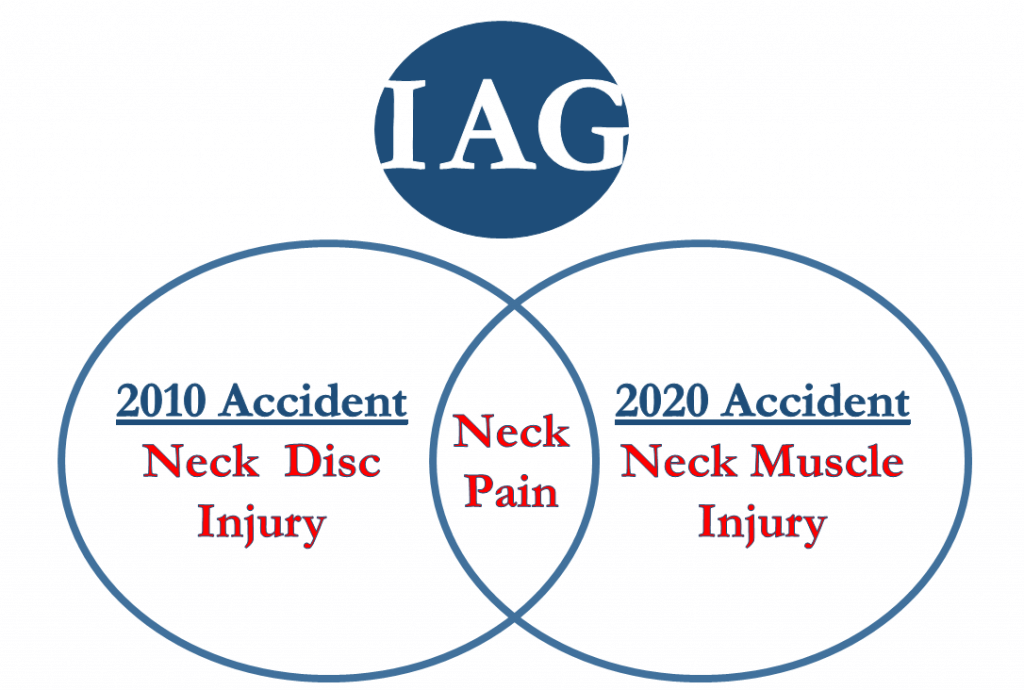

Murky Waters for Apparently Similar Injuries

Using the last hypothetical above, if you successfully distinguish the two neck injuries from the two accidents, the insurance adjuster is likely to give one of two responses.

Adjuster Response#1:

Different Injury, But Similar Symptoms

First, if the adjuster is medically savvy (unlikely) or has a nurse or chiropractic consultant who reviewed your medical records for her (very likely), the insurance adjuster may grill you on the residual symptoms following your 2010 neck fusion surgery. Those surgeries may leave permanent residual symptoms.

In other words, even though the injuries are different, their resulting symptoms could overlap. An oversimplified visual could look like this:

There is a way to overcome this hurdle.

Eliminating the Similar Symptoms Problem

You have to prove that you made a 100% recovery from the 2010 car accident and neck surgery. This is primarily done through your medical records. The past several years of your medical records should be collected, then merged together and organized by date. A clean timeline of those records should be provided to the adjuster, showing that you had no neck pain before the accident.

There are two hurdles with doing this. A labor hurdle and a you don’t know what you don’t know hurdle. The second hurdle could have serious blowback that results in the insurance adjuster trying to lowball you even more.

Eliminating the Similar Symptoms Problem: Labor Challenges

This is not easy because this project takes many hours. The process of requesting and collecting medical records from multiple medical providers is time consuming. Organizing multiple sets of medical records into one set, sorted by date, is cumbersome, and even more time consuming. Walking an adjuster through those records takes even more time.

This is part of the reason people hire lawyers. Handling the claim is a job in itself. You have a life outside your car accident claim, so you hire someone else to deal with this headache for you.

Eliminating the Similar Symptoms Problem: Risky Blowback

Even if you roll up your sleeves and complete those tasks, it could backfire. The insurance adjuster knows this, which is why they will be happy when you offer to give them your prior medical records. There is a very good chance your prior medical records will include small pieces of information that the insurance adjuster can take out of context and use to lowball you even more.

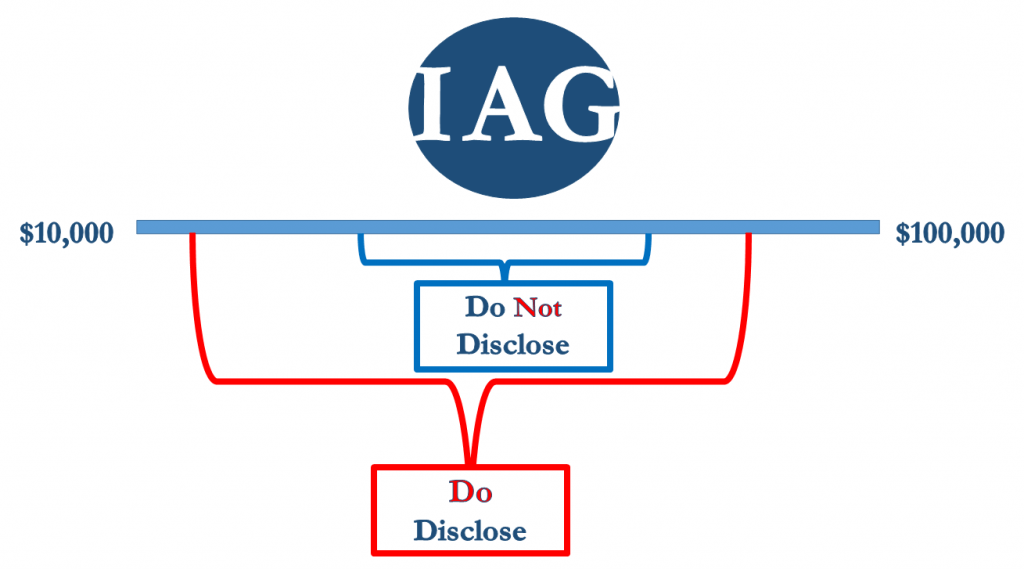

For our clients, we deal with this on a case by case basis. First the prior records are collected. If there is something potentially harmful in those records, the decision may look like this:

The settlement offers are in brackets because case values, and how certain facts can change those values, are discussed in terms of ranges. We discuss that on our verdicts and settlements page.

There is no telling what, specifically, the negative impact will be of sharing those records with the insurance adjuster. What is known for sure is that it presents a risk.

Although sharing those records can increase the value of your case some, it comes with a risk that pushes the fair range of your case value down, which is what the above illustration shows with the red bracket. Another way of explaining it is that you have a more predictable settlement range without producing those records.

You should NEVER give an insurance adjuster your prior medical records without speaking to a lawyer. There is no exception to this rule. You could see your lowball insurance settlement offer go even lower, or disappear altogether.

A sample response for this scenario does not exist. The only solution is a detailed review of your pre-accident and post-accident medical records, with a skilled analysis of how your specific facts create risks that should be hedged into the valuation of your case.

Adjuster Response #2:

Oblivious or Handcuffed Adjuster

Second, even if you distinguish the injuries and symptoms, the adjuster may not be sophisticated enough to appreciate or understand the medical homework you did and are trying to explain. We know, we have been in this situation.

Alternatively, the adjuster will get it, but is handcuffed because an insurance algorithm is not allowing a better offer. We have been in this situation, too.

In that situation, the best response to that low settlement offer is to file a lawsuit. If the facts and the truth do not help the insurance adjuster and insurance company see the light, a lawsuit probably will.

If you want to learn how to respond to a low settlement offer that is based on a pre-existing injury, scroll down to Chapter 2. To browse the list of other lowball offer responses, return to the Table of Contents.

Call or Message Us 24/7

(800) 484-0779

Your

Los Angeles Motor Vehicle Accident Attorney

Click or Tap for a Free Consultation

Chapter 2:

I Have Pre-Existing Health Problems

They’re Blaming Your Past

Can Pre-Existing Health Problems Hurt Your Settlement?

If an insurance adjuster is trying to lowball you based on your pre-existing health problems, you need to start by reading Chapter 1. Chapter 1 explains the fundamentals of how to distinguish whether your pre-existing injury does or does not hurt your settlement payout.

Once you know that, you will know how to respond to a low settlement offer in a factual, and substantive way that beats the insurance adjuster’s strategy with the truth. Accomplishing that is based on detailed information about your injuries.

The Two Injury Factors

Using the information learned in Chapter 1, we can answer the question in the title of this Chapter. Yes, a pre-existing health problem can hurt your settlement if it is:

♦ An injury to the same area of your body

♦ The same type of injury in that same area of your body

In terms of injury factors that control your settlement, these are the two key factors.

Some Prior Injuries Are Worse Than Others

The first scenario (injury to same body part) is not as bad as the second scenario (same type of injury to the same body party), in terms of its negative impact on your settlement.

An example of the first scenario would be cervical disc injury to your neck in 2010 and a soft tissue whiplash injury to your neck in 2020. Two different injuries, but to the same body part.

An example of the second scenario would be a soft tissue injury to your neck in 2010 and another soft tissue injury to your neck in 2020.

Sample Response to Low Settlement Offer for Same injury on Same Body Part

Even if you are in the second scenario (same type of injury to the same body party), your case is not lost, and there are ways to fight back against the insurance company. The most productive way to do this is with facts, not arguments. One approach is outlined below as an example.

Sometimes You Can Chart the Differences

If you had a soft tissue injury to your neck in 2010 and another soft tissue injury to your neck in 2020, you would be in this boat.

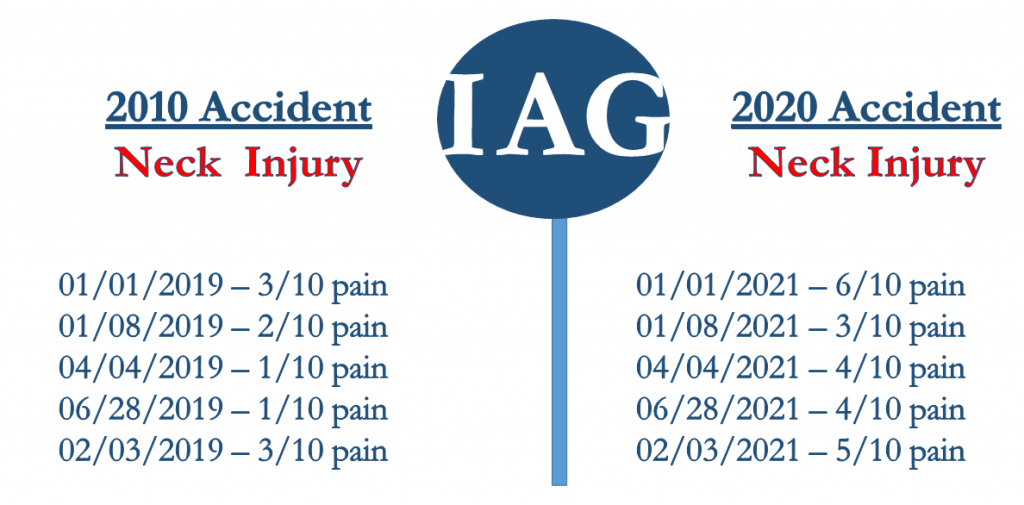

For a client like this, we would collect your medical records from before and after the vehicle accident. All the references to your neck would be outlined and organized. A possible visual might look like this:

If you are in the very, very rare situation where you can create a numerical chart like this, this chart is a great sample response to a low settlement offer if you suffered the same injury to the same body part in an incident before your vehicle accident.

Most of the Time You Can’t Chart the Differences

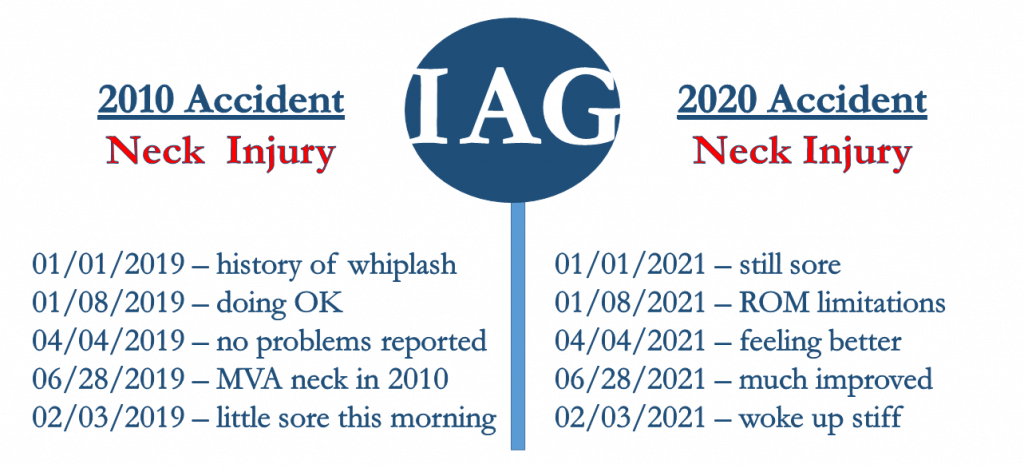

Charting the differences is easier said than done. Putting aside the very cumbersome nature of collecting and organizing all the medical records necessary to do this, combing through them, then outlining them, the facts are rarely this simple or helpful.

Almost all of the time, your chart will look like this:

This is very common, and will make charting not viable for many cases. Sometimes it can still work, if the descriptive adjectives are sufficiently distinguishable.

For example, if in 2019 it says “just a little stiff,” and in 2021 it says “very stiff,” then you can successfully using charting as a way to expose lowball offers based on pre-existing medical conditions.

Problems with Ambiguous Medical References

What is unfortunately also very common is post-accident progress notes in your medical records which chart your improvement (e.g., “feeling better” or “much improved”) in a way that hurts your case.

Take for example the 04/04/021 progress note of “feeling better” from the chart immediately above. Your pain could have been a 10/10 at the last doctor visit a week before, and now it is an 8/10.

What does that mean? It means you are FEELING BETTER than last week. Technically, this medical record is accurate. At the same time, it gives a confusing impression of how bad your injury is, and the adjuster will shove that in your face and try to use it against you.

Overcoming Ambiguous Medical References

Your doctors are not writing medical records to help your settlement or lawsuit. Medical personnel write very abbreviated and summarized notes. These crunched up notes result in sound-bites like the one discussed above which are missing context or substance.

This is a good time to take a short quiz. What happens when an insurance adjuster or insurance company sees a fact in your medical records which is vague, confusing, or can be interpreted in a way that either hurts or helps you?

(A) Adjuster tries to find out the truth and what it means

(B) Adjuster argues it hurts you despite the truth and gives a lowball offer

You know the answer, and it is why you need a lawyer in these situations. There is no template response for this situation. It requires a lot of medical knowledge about your specific injuries and familiarity with interpreting those medical records.

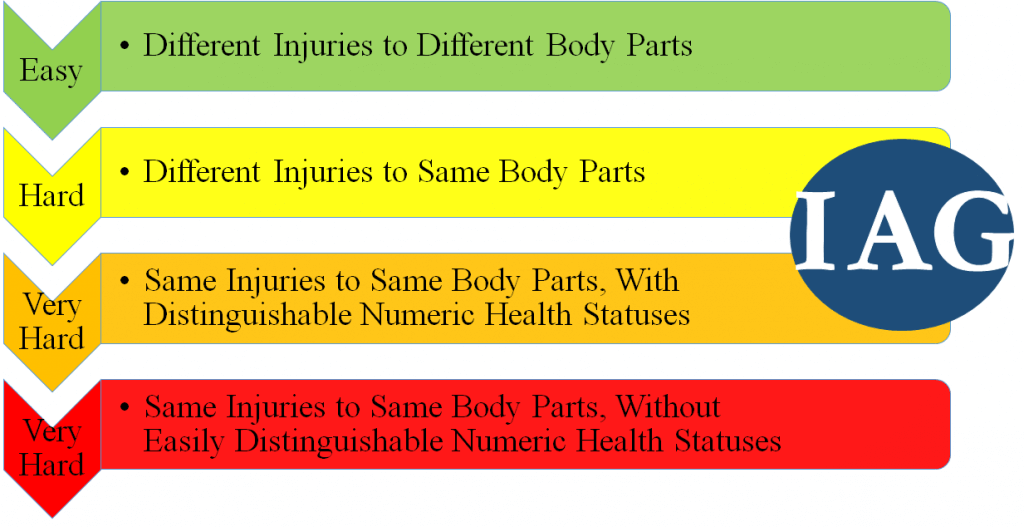

4 Levels of Pre-Existing Injury Related Lowball Offers

A visual which summarizes this Chapter may help you decide whether to wing it or hire an attorney. The colors on the visual show the difficulty of exposing the lowball offer based on pre-existing injuries with respect to the complexity and time involvement of your needed efforts:

There are some car accident settlement scenarios where you need a lawyer, and some that you do not. It is important to identify those scenarios early to put yourself in the best situation to protect your settlement payout.

If you guess wrong, it means you will speak and exchange information with the insurance adjuster without an attorney to protect you. In 100% of those situations that we have dealt with, the insurance adjuster got the best of our client and we were stuck trying to dig the client out of a hole.

A good lawyer can do very good with the cards they are dealt. Even with mediocre cards a good settlement payout is on the table. However, if you show the insurance adjuster your cards and then call a lawyer, it is questionable whether even Doyle Brunson can win that hand.

That said, it is never too late to call a lawyer. If you are hurt and need help, it is the only prudent thing to do.

To learn how to respond to a low settlement offer that is based on how the damage to your car looks, scroll down to Chapter 3. To browse the list of other lowball offer strategies and responses, return to the Table of Contents.

Call or Message Us 24/7

(800) 484-0779

Your

Los Angeles Motor Vehicle Accident Attorney

Click or Tap for a Free Consultation

Chapter 3:

My Car Does Not Look That Bad

They’re Twisting the Accident Scene

Does Little or No Car Damage Mean Little or No Injury?

Property Damage ≠ Injury Severity

If you are faced with an insurance adjuster trying to lowball you because the property damage to your car is minimal, we have good news. “Property damage is an unreliable predictor of injury risk or outcome in low velocity crashes.” A.C. Croft & M.D. Freeman, Correlating crash severity with injury risk, injury severity, and long-term symptoms in low velocity motor vehicle collisions, Med. Sci. Monit., 11(10): RA316, RA320 (2005).

Even better, “There is a lack of relationship between occupant injury, vehicle speed and/or damage.” Davis CG. Rear-end impacts: vehicle and occupant response. J Manipulative Physiol Ther. 1998 Nov-Dec;21(9):629-39. PMID: 9868635.

We can go on and on about this, including the fact that the United States Government’s National Highway Traffic Safety Administration explains that “Automobile bumpers are not typically designed to be structural components that would significantly contribute to vehicle crashworthiness or occupant protection during front or rear collisions.”

Response to Adjuster Offers Based on Property Damage

If you are faced with an insurance adjuster trying to lowball you based on the property damage to your vehicle, you can turn the table on the adjuster and turn this into a secret weapon to help improve your position. To accomplish that, you need hard evidence to educate the insurance adjuster on why she or he is wrong.

To save you a few weeks of research, here is a comprehensive list of scientific evidence which debunks this insurance adjuster argument as a myth:

♦ Gunter P. Siegmund, Whiplash Injury: Vehicle, Seat, Occupant & Tissue Responses 1 International Spinal Trauma Conference, Chicago, IL (June 20-22, 2003)

♦ A.C. Croft & M.D. Freeman, Correlating crash severity with injury risk, injury severity, and long-term symptoms in low velocity motor vehicle collisions, Med. Sci. Monit., 11(10): RA316, RA320 (2005)

♦ M.C. Robbins, Lack of Relationship Between Vehicle Damage and Occupant Injury, SAE Technical Paper No. 970494 (1997)

♦ Murray Kornhauser, Delta-V thresholds for cervical spine injury SAE Technical Paper No. 960093 at 10-12, SAE International Congress & Exposition, Detroit Michigan (February 26-29, 1996)

♦ C.J. Centeno, M. Freeman, W.L. Elkins, A review of the literature refuting the concept of minor impact soft tissue injury, Pain Res. Manage. 10(2): 71-74 (Summer 2005)

♦ Davis CG. Rear-end impacts: vehicle and occupant response. J Manipulative Physiol Ther. 1998 Nov-Dec;21(9):629-39. PMID: 9868635.

♦ Emil Seletz, MD, Journal of the American Medical Association. November 29, 1958, pp. 1750-1755

♦ Lotta Jakobsson, Bjorn Lundell, Hans Norin & Irene Isaksson-Hellman, WHIPS – Volvo’s whiplash protection study 32 Accident Analysis and Prevention 307, 309 (2000)

♦ Michael D. Freeman, Arthur C. Croft, Annette M. Rossignol, David S. Weaver & Mark Reiser, A review and methodologic critique of the literature refuting whiplash syndrome 24(1) Spine 86 (1999)

♦ Lundell, L. Jakobsson, B. Alfredsson, M. Lindstrom, L. Simonsson, The WHIPS seat – A car seat for improved protection against neck injuries in rear end impacts, Proc. 16th ESV Conference, Paper No. 98-S7-O-08 (1998)

♦ Charles C. Davis, Rear-end impacts: vehicle and occupant response 21(9) Journal of Manipulative and Physiologic Therapeutics 629, 634-635 (1998)

If you are wondering how to respond to a low settlement offer based on this information, here is what we do:

♦ We ask the insurance company to share with us the evidence they have to support this argument (they have none)

♦ We share the evidence we have (which is a lot, outlined above)

♦ They either increase the settlement offer or we file a lawsuit (using our scientific evidence in the case)

There is not much else to dealing with this. Unlike dealing with some of the other tricks, responding to this one is fairly simple.

How Adjuster’s Respond to This Truth

You have heard of the saying “the truth hurts.” Insurance companies love their “low property damage” excuse so much they usually can’t accept reality. It is often too painful for them to accept the truth and increase your offer after the inaccuracy of their excuse for making that bad offer is exposed. For that reason, these cases often require a lawsuit.

Our lawyers have recovered settlements of over $25,000 and over $250,000 for clients whose vehicles had no visible property damage. In some cases, we obtained these victories for clients after they received a $0.00 offer based on the lack of property damage. These cases take work, but they are winnable.

To learn how to respond to a low settlement offer that is based on you not leaving the accident scene in an ambulance, scroll down to Chapter 4. To browse the list of other lowball offer strategies and responses, return to the Table of Contents.

Call or Message Us 24/7

(800) 484-0779

Your

Los Angeles Motor Vehicle Accident Attorney

Click or Tap for a Free Consultation

Chapter 4:

I Did Not Leave the Scene in An Ambulance

They’re Twisting the Accident Scene

Should You Have Left the Scene in An Ambulance?

The Fake Secret Behind this Insurance Adjuster Attack

My Insurance company is low balling me because I did not leave the accident scene in an ambulance, what should I do? Tell the truth!

This is a very common excuse that insurance adjusters use to argue that you should get a lower offer. Do not be offended by this. The insurance adjusters are not creative enough to come up with this on their own, and they are not fairly or honestly evaluating your claim when they say this.

They are, unfortunately for them, human robots being used as pawns by the insurance company. They are given a playbook, and are not allowed to deviate from it, even if it does not sit well with their logic or conscious.

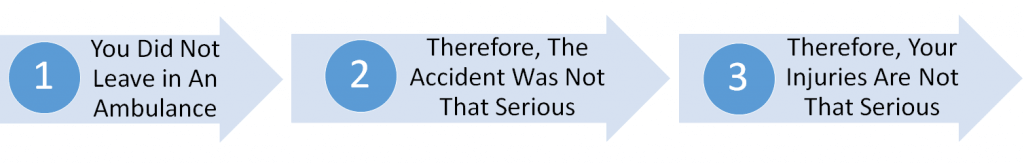

This particular attack is based on this unscientific sequence of thoughts that they are instructed to regurgitate:

From that, they argue “the evidence shows your injuries could not be serious and my offer is based on that.” This is dishonest.

To get a flavor of why, read Chapter 3 which explains a very similar situation. Chapter 3 exposes one of the insurance company’s favorite secrets as false – that your settlement offer should be lower if the damage to your vehicle is not serious.

In Chapter 3, we taught one of our secret tactics for exposing untruthful insurance adjuster justifications for bad offers. We ask the insurance adjuster to explain the evidence or proof that backs up their justification.

If you ask an insurance for that justification on this no ambulance no good offer excuse, this is what you will hear in response:

That is right, crickets. There is no scientific evidence to support this connection. The absolute best excuse the insurance adjuster may come up with is the fallback they use for all of their worst excuses: “it is common sense.”

Fighting Fire With Fire

This is another issue for which you can turn the tables on the insurance adjuster. Here are a few “common sense” sample responses to low settlement offers on this issue:

♦ My kids were in the car, I was not going to abandon my kids when I could drive myself to the ER

♦ I did not want to pay hundreds or thousands of dollars for an ambulance ride if I could drive myself

♦ I had a herniated disc, not a broken bone, so I was able to drive to the hospital

The bottom line is, a sample response to a low settlement offer based on this insurance adjuster tactic would include a simple, straightforward explanation of all the different reasons why you did not leave the accident scene in an ambulance. These explanations are always common sense (the same tactic the adjuster tried to use), except they are grounded in truth (unlike the adjuster’s).

What Would You Do, Mr. Adjuster?

Sometimes, it is also fun to ask the adjuster, “would you leave in an ambulance if ________?”

It does not matter what the response is. Either they will be truthful and increase the offer, or they will force themselves to deny the truth and you will hear the lack of commitment in their voice, revealing where they really stand.

Scroll down to read Chapter 5, how to address an insurance adjuster’s low offer that is based on you not immediately seeing a doctor after the accident. Alternatively, return to the Table of Contents and brose the full list of topics in this article.

Call or Message Us 24/7

(800) 484-0779

Your

Los Angeles Motor Vehicle Accident Attorney

Click or Tap for a Free Consultation

Chapter 5:

I Did Not Immediately See a Doctor

a/k/a "Delayed Treatment"

They’re Attacking the Timing of My Treatment

I Waited to See a Doctor

Delayed Treatment = Smaller Settlements

If an insurance adjuster’s low offer is based on you delayed initial treatment, you could have a problem. The bottom line is, hurt people get medical care. There is no law or statutory rule on that (no, “mitigation of damages” is something different). However, there is a generally accepted common sense presumption on it.

Like most presumptions, this presumption is rebuttable. You must come forward with facts that show why this general principle does not apply to your case, or why your case is an exception to this rule. If you do not, the longer you waited to see a doctor after the accident the more your settlement payout is compromised.

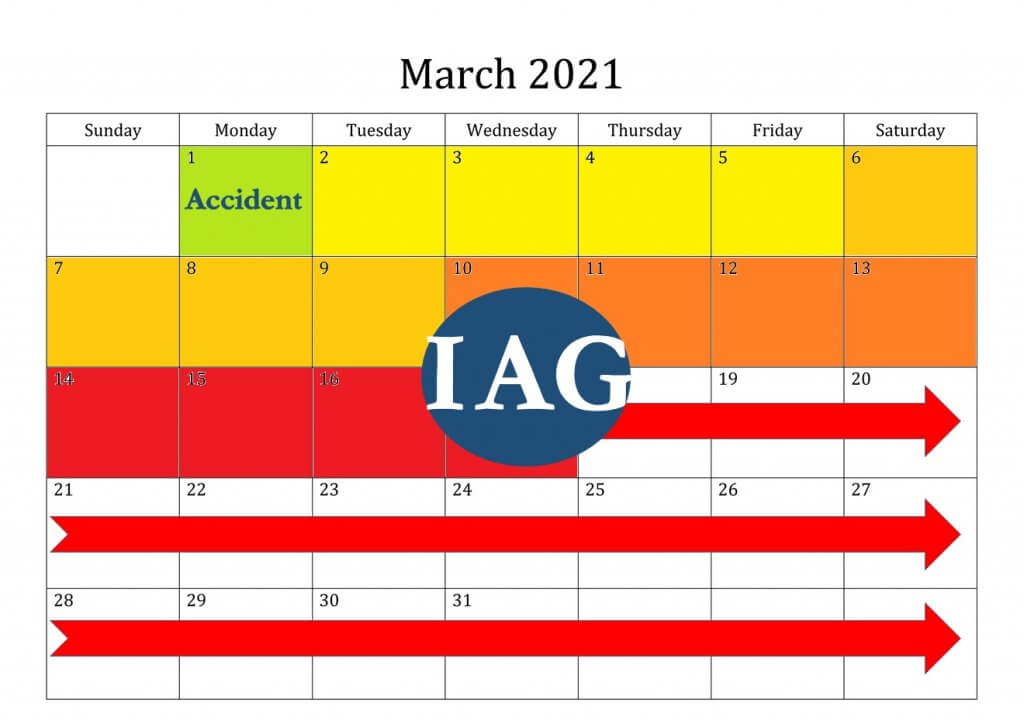

An overgeneralization would look like this:

Even a one day delay will be used against you (March 2nd, yellow). A few days will certainly hurt (March 2-5, yellow). A week and your settlement is taking bit hits (March 6-9, light orange). Beyond that and you are likely losing thousands of dollars, if not tens of thousands.

Remember, this an overgeneralization. Our lawyers have achieved six figure settlements where a client waited approximately a week before seeing a doctor.

You need an honest, factual, explanation to rebut the presumption. If you have that, the lowball offer should be adjusted and any discount the adjuster subtracted for this reason should be reversed.

Secret Counterattack to Lowball Strategy:

Good Reasons for Delayed Treatment

You are learning that the most effective way to fight back against an insurance adjuster’s low ball offer is with a one-two punch. On the issue of delayed treatment, Punch #1 is:

For Punch #1, if the adjuster highlights your delay in initial treatment, you ask the adjuster questions along the lines of:

♦ Is part of the reason my offer is $___ because my first doctor visit was 4 days after the accident?

♦ Why does that decrease my settlement offer?

♦ Would my settlement be higher if I saw a doctor the same day, how much?

Then, you land the second punch:

These are not excuses or lengthy explanations. These are facts. They are short and sweet. Some powerful facts that fall into this category for delayed treatment include:

♦ I did not have health insurance; could not afford the bills

♦ My work made it unrealistic to get immediate treatment

♦ I self medicated at home until the pain became unbearable

When to Lawyer Up

If the insurance adjuster refuses to accept logic and does not budge despite learning the truth, it is time to call a lawyer. Also, if playing this game of cat and mouse that the insurance company makes you play is too stressful, you should also call a lawyer.

We hope we do a decent job of making these approaches sound easy, but in truth they are not. The technique in presentation is just as important as the substance being presented. That is something that you pick up with time, having conducted hundreds of these negotiations like our lawyers have done.

Continue reading to learn the most commonly used insurance claim adjuster secret tactic – gaps in treatment – and how to fight back against it. To browse the full list of insurance adjuster strategies for low balling you, return to theTable of Contents.

Call or Message Us 24/7

(800) 484-0779

Your

Los Angeles Motor Vehicle Accident Attorney

Click or Tap for a Free Consultation

Chapter 6:

I Had "Gaps" in My Medical Treatment

a/k/a "Inconsistent Treatment"

They’re Attacking the Timing of My Treatment

Gaps in Treatment

This is hands down every insurance claim adjuster’s favorite secret tactic, and for good reason. It works. Juries and judges will discount how much money you get if you have gaps in treatment. At all costs, you must avoid having any legitimate gaps in treatment.

How much a gap in treatment decreases your settlement payout and hurts your case will depend on:

♦ Nature of the gap(s)

♦ Length of the gap(s)

♦ Number and frequency of the gap(s)

To understand this insurance secret and how to fight back, we will teach you 3 things in this Chapter:

♦ Definition of a gap in treatment

♦ When it Can Hurt Your Case

♦ How to Respond if the Adjuster is Misusing it to lowball you

Definition of a Gap in Treatment

A gap in treatment is when there is a break in the continuity of your medical treatment.

A lowball offer from an insurance company due to a gap in treatment is sometimes based on a trick definition of what a gap in treatment is. Here is a side-by-side of the real definition with the definition that insurance adjusters may use to trick you:

Just because you had 5, 10, or 15 days between doctor visits does not mean there is a gap in your treatment that warrants discounting or lowering your settlement offer.

If an insurance adjuster is complaining about gaps in your treatment, the first thing we would do is ask what definition the adjuster is using to decide those gaps exist.

When Can a Gap in Treatment Hurt Your Case

A gap in treatment can hurt your case if it is a real gap – a break in the continuity of your treatment – without a compelling reason for the gap. In terms of how much it will hurt your case, it will depend on the 3 factors we identified earlier:

♦ Nature of the gap(s)

♦ Length of the gap(s)

♦ Number and frequency of the gap(s)

An illustration will help you understand this.

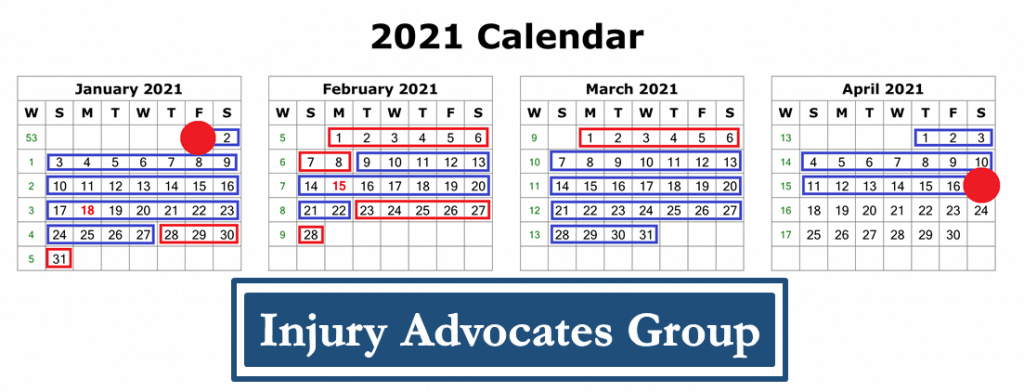

In the calendar below, we map out a hypothetical patient’s treatment. The first red circle represents the day of the accident and first doctor visit. The blue bordered dates represent uninterrupted medical treatment. The red bordered dates represent gaps in treatment. The second red circle represents the last date of medical treatment.

Once we use all of this patient’s medical records to create this illustration, here is what we can see about the patient’s treatment gaps:

♦ Patient had 3 1/2 months of treatment

♦ Patient had 2 gaps in treatment

♦ First treatment gap was 12 days

♦ Second treatment gap was 12 days

Without knowing anything else, this does not bode well for this patient’s settlement payout.

Out of 3 1/2 months of treatment, the patient had 24 days of treatment gaps. The patient also had approximately one treatment gap for every 1 1/2 months of treatment. Again, not good. If this is the only information we know, and there is no substantial reason for these gaps, the insurance adjuster’s lowball offer may have a leg to stand on.

Sample Response to Low Settlement Offer Based on Treatment Gaps

In practice, it is rarely as simple as the above hypothetical. To show you why, let’s continue with the hypothetical but add some facts.

What if each of the 12 day gaps in treatment represent only one missed doctor visit, right in the middle of each gap; i.e., a missed appointment on February 2nd and March 1st. We will place those on the map with yellow circles to help you visualize it:

That means just 2 doctor visits would eliminate 100% of the treatment gaps (all 24 days). Another way of looking at it is those two doctor visits bridge the gaps, eliminating them. More specifically:

♦ The missed doctor appointment on February 2 bridges the gap for the doctor visits of January 27 and February 9 (look at the calendar above and related colors and you will better understand this explanation)

♦ The missed doctor appointment on March 1 bridges the gap for the doctor visits of February 22 and March 7

When you match up those dates with the calendar you see what is being referenced.

Hypothetically, if we can undo just two doctor visits, the gaps are gone because each doctor visit is bridged consistently to the next doctor visit without any gaps; i.e., there is continuity in treatment, which is the opposite of the definition of a treatment gap.

You can’t undo the missed doctor visits, so what can you do instead? Substantiate the gaps.

For example, did you miss those two doctor appointments because you had to pick your kids up from school? Did you not have a car? Did you neck lock up from the whiplash injury and you did not feel safe driving?

Bridge the Gaps

This is how we defeat an insurance adjuster’s low offer based on a treatment gap.

First, we map out the gap to understand how bad it is using the 3 factors (nature of gap, length of gap, number of gap). Then, we work hard to bridge the gaps with facts.

The justification for your gaps will determine how strong that bridge is. Weak reasons or shaky excuses are straw bridges, and will not help you increase the lowball offer.

On the other hand, one of our lawyers helped a client who had a multi-month gap in treatment due to fighting cancer. This was explained to the adjuster, and the lowball offer was replaced with a genuine one that represented the top range of value for that claim.

Sometimes, a lot of brainstorming and some creativity is needed to bridge the gap. When there is a will, there is a way.

If you have hit a wall with the insurance company, give us a call. We will work with you to climb over that wall. If that does not work, we will break through it and file a lawsuit, putting the insurance company on the defensive.

Final thoughts on low ball offers are below. If you jumped to this Chapter and want to browse the other Chapters, you can return to theTable of Contents and browse the list of insurance adjuster lowball tactics.

Get Help

My Insurance Company is Low Balling Me,

What Should I Do?

The Truth Will Set You Free

The truth is, and what you have hopefully learned by reading this article, is that almost all of an insurance claim adjuster’s secret tactics are based on untruthful assumptions and a twisted view of reality.

Arguing against with the insurance adjuster will not increase your settlement payout. You have to fight fire with fire. The secret tactics in this article will help you expose the truth do just that.

Worth mentioning that this article does not cover every trick in the book. For example, it does not cover insurance company’s using surveillance to lowball you. This is a common trick because the surveillance is often highly redacted, highly edited, and includes dozens of hours of undisclosed footage which, if disclosed, would paint the real picture of how injured you are.

Not Legal Advice

A necessary disclaimer: None of the information provided on this webpage is legal advice. We only apply these principles and strategies to the specific facts of a case for clients who hire us to help them. Depending on the insurance company, adjuster, and specific facts of your case, we might never use some of these approaches even though they technically can be used based on the reason for the lowball offer.

There are too many exceptions to the rules in the world of law and medicine for any lawyer to suggest that any canned strategy can, without detailed analysis, be applied to a particular fact pattern.

It gets even more complicated if there are multiple excuses for your lowball offer. You have to hedge against each with your individual responses, taking into account the net global impact on your settlement payout.

IAG‘s Los Angeles Lawyers Are Here for You

This is what we do for a living. If you would like help, call, email, or send us a message using the contact form below.

Regardless of where you are or where your accident happened, we can help you.

Call, email, or message us using the contact form below, 24/7, for your free consultation with one of our Los Angeles based lawyers. We are on standby to help car accident victims like you beat any lowball insurance settlement offer and maximize your settlement. A 30 minute FREE attorney consultation is just a phone call away.

About the Author

Article Author: This law article was written by attorney Ray Benyamin, Esquire. Mr. Benyamin received his Juris Doctor degree from the Thomas Jefferson School of Law, and his license to practice law from the State Bar of California. His law license number is 277263. He has been practicing law for 10 years. Mr. Benyamin is a registered member of the following legal organizations: Consumer Attorneys Association of Los Angeles (CAALA), the Los Angeles County Bar Association (LACBA), the State Bar of California, the American Bar Association (ABA), and the American Association for Justice (AAJ). Mr. Benyamin has personally helped his clients recover over $10,000,000 dollars in vehicle accident insurance claims in the State of California.

Our Lawyers Serve Clients in Los Angeles, California & Nationally

Serving all of Los Angeles, including Arcadia, Beverly Hills, Claremont, Canoga Park, Chino, Chino Hills, Covina, Diamond Bar, Downey, East Pasadena, El Monte, Encino, Highland Park, Inglewood, La Verne, Long Beach, Malibu, Montebello, Monterey Park, North Hollywood, Northridge, Pasadena, Pomona, Rancho Cucamonga, Reseda, Rosemead, San Gabriel, San Dimas, Santa Monica, Sherman Oaks, South Bay, South LA, South Pasadena, Sunland, Tarzana, Thousand Oaks, Torrance, Van Nuys, Venice, West Covina, West Hollywood, and Westlake Village.

Serving all of California, with a focus on Kern County, Los Angeles County, Orange County, Riverside County, San Bernardino County, San Diego County, Santa Barbara County, and Ventura County.

Serving nationwide in all 50 states on a case-by-case basis with a national network of relationships and on a Pro Hac Vice basis.